ELECTRIUM DOMESDAY DIGITAL ASSET

1. Executive Summary

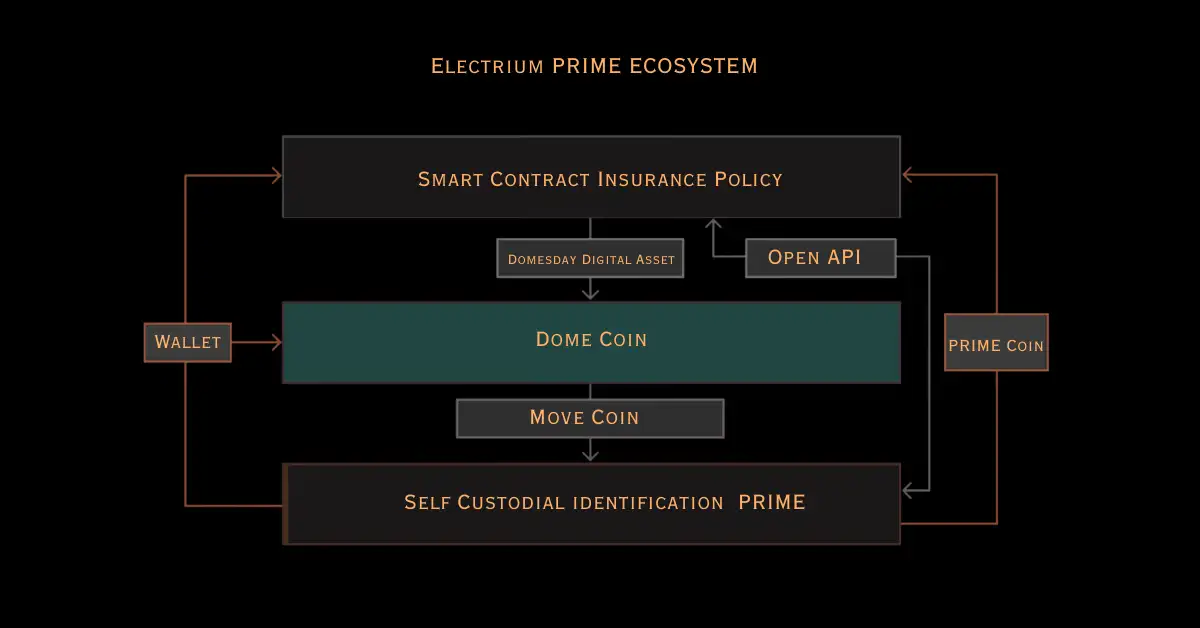

The Electrium Domesday Digital Asset is a tokenized, lifelong smart contract insurance as a service policy designed as a non-inflationary, stable-price, and yield-generating digital asset. It represents a convergence of insurance mechanics, blockchain technology, and decentralized finance, providing policyholders with a secure, productive, and inflation-resistant store of value. Distribution is primarily executed through Insurance Coin Offerings (ICOs), enabling broad adoption and accessibility within the Electrium ecosystem.

By merging traditional insurance frameworks with programmable blockchain architecture, the Domesday Digital Asset transforms conventional policies into verifiable, transferable, and economically productive digital instruments, bridging the gap between risk management and decentralized finance.

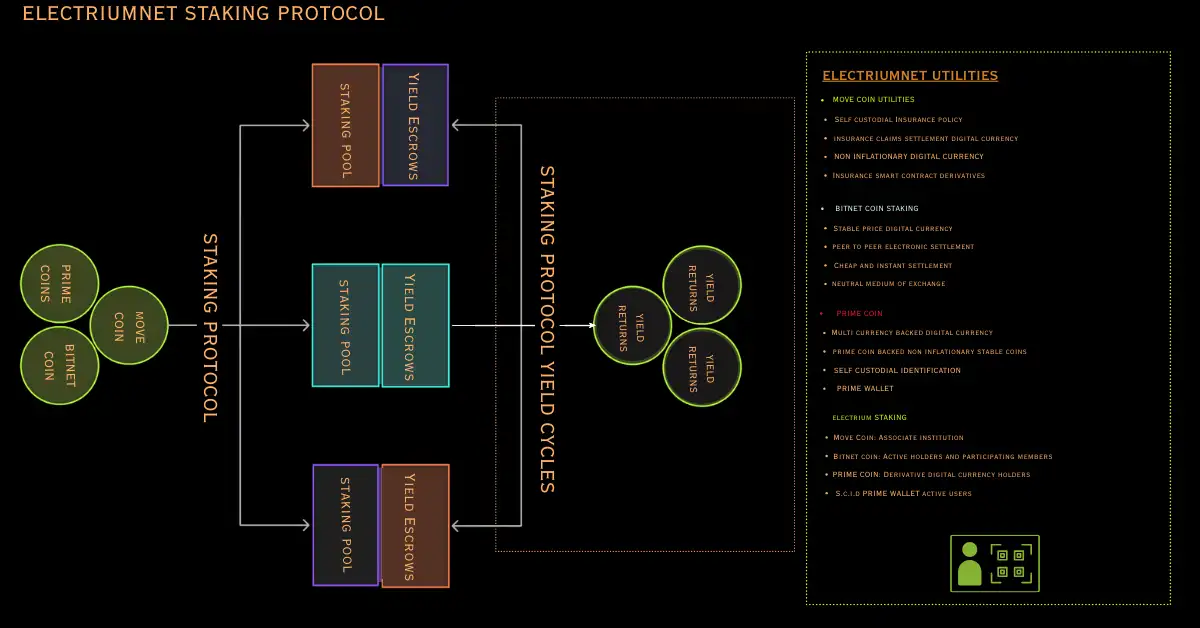

2. Electrium Net Protocol Architecture

The Electrium Net Protocol is designed as a four-layer smart contract insurance architecture, optimized to issue, settle, and manage lifelong insurance policies on-chain.

2.1 Layer 0 – Standardized Lifelong Insurance Policy

At the foundation, Layer 0 provides a fully standardized, lifelong insurance contract encoded directly as a programmable smart contract. This layer establishes:

-

Immutable terms and payout logic

-

Transparent, auditable, and enforceable policy rules

-

Universal applicability across jurisdictions, industries, and derivatives

2.2 Upper Protocol Layers

Building on Layer 0, successive layers interface with the public blockchain to provide:

-

Full transparency and verifiable accountability

-

Secure self-custody for policyholders

-

Privacy-preserving mechanisms for sensitive policy data

-

Seamless interoperability across the Electrium ecosystem

This layered design transforms traditional insurance into a trustless, decentralized, and enduring digital asset ecosystem.

3. Tokenization of Insurance Policies

The Layer 0 smart contract is tokenized to create the Electrium Domesday Digital Asset, a derivative financial instrument that:

-

Combines the risk-transfer mechanics of an insurance policy with the security and reliability of a digital asset

-

Stores and preserves value against external risks

-

Generates yield through network adoption and protocol utilization

The token’s value is reinforced by:

-

The immutable ledger of the Electrium protocol

-

Network effects from increasing adoption

-

Transparent and verifiable insurance mechanics

This approach ensures stability and demonstrable utility, independent of speculative market behavior.

4. Transforming Insurance into Digital Reserve Assets

The Domesday Digital Asset fundamentally changes the nature of insurance:

-

From liability transfer to verifiable digital store of value

-

Validated through protocol mechanics, ledger immutability, and active utility

-

Eliminates speculative risk and inflation in primary markets

It functions as the foundational digital reserve of the Electrium insurance digital network economy, underpinning the issuance of a broad range of derivative, self-custodial insurance policies, including:

-

Personal wealth and life coverage

-

Medical and health insurance

-

Automotive and property protection

-

Business and commercial risk coverage

By anchoring these products to a stable, trustless, and verifiable reserve asset, the Domesday Digital Asset ensures that all derivative policies inherit:

-

Reliability and consistency of valuation

-

Verifiability and auditability

-

Global interoperability and accessibility

-

Enhanced liquidity for direct settlement

5. Scalable Insurance Infrastructure

The Domesday Digital Asset transforms the Electrium ecosystem into a scalable insurance infrastructure, where every policy regardless of industry or jurisdiction:

-

Anchored to a secure digital insurance asset

-

Converted from a traditional contractual risk-transfer agreement into a self-custodial, non-inflationary digital asset

-

Designed to specialize in preservation of value and economic sovereignty

This architecture not only increases trust in the insurance system but also ensures that policyholders and institutions benefit from long-term stability, transparency, and utility, while enabling global adoption of decentralized insurance protocols.