BLACKPAPER BLUEPRINT : BITNET COIN

Bitnet Coin: B.t.d.c : Peer to peer transaction settlement network & solving the utility & adoption problem.

Bitnet Treasury Digital Currency is a non-inflationary stable price digital currency backed by the electrium prime ecosystem and bitcoin engineered to enable seamless, secure and efficient electronic peer2peer transactions settlement worldwide.

Abstract : cross currency settlements without going through a traditional financial institution. Bitcoin may provide part of the solution, but alone it lacks the stability & utility for active adoption, the main benefits are also lost when financial institutions like central banks are required to settle the transaction in Central Bank Digital Fiat Currencies. We propose a simplified solution to digital crypto currency lack of active adoption & the highly fragmented international financial network for trade settlement by using a universal peer to peer ledger protocol that allows offshore accounts to seamlessly Integrate. The network uses a single ledger that records all transactions but keeps them private within the peers transacting. The universal ledger serves as hash based proof of transaction where the validity of all transaction records are verified. To settle transactions in the peer to peer ledger network & increase digital currencies adoption & utility, a reserve digital currency for the network secured by a recognized & trusted digital asset & the collective trustless network is required and strengthened over time through the network effect.

Introduction

International payment settlement relies exclusively on financial institutions serving as trusted third parties in the process of payment settlement. While the system has survived till now through governments bail out and unsecured money printing, the current system is what led to the financial crash in 2008. It still suffers from inherent systemic flaws that leave the financial vulnerabilities that are exploited. Bitcoin provided half of the solution by providing a system for digital peer-to-peer transactions & the solution to double spending, however bitcoin is a digital asset and alone cannot fulfill the role of true internet digital money.

Bitcoin as a digital asset, is a secure and widely accepted store of value but it lacks a native digital currency layer or protocol that enables active utility. While Bitcoin shares many characteristics of a strong reserve asset, similar to gold, it requires an accompanying digital currency with real-world use to drive consistent demand and adoption through active circulation.

B.T.D.C: Bitnet Treasury Digital Currencies represents a new class of digital currencies, alongside but parallel to C.B.D.C: Central Bank Digital Currencies to be mainly differentiated by their functions and features. While it is backed by network utilities, successful adoption requires thoughtful financial engineering, B.t.d.c requires well-aligned incentives to ensure its attractiveness & broad adoption that will fuel further development of a robust, secure, and trustless network of participants capable of supplying liquidity and driving growing demand across the economy.

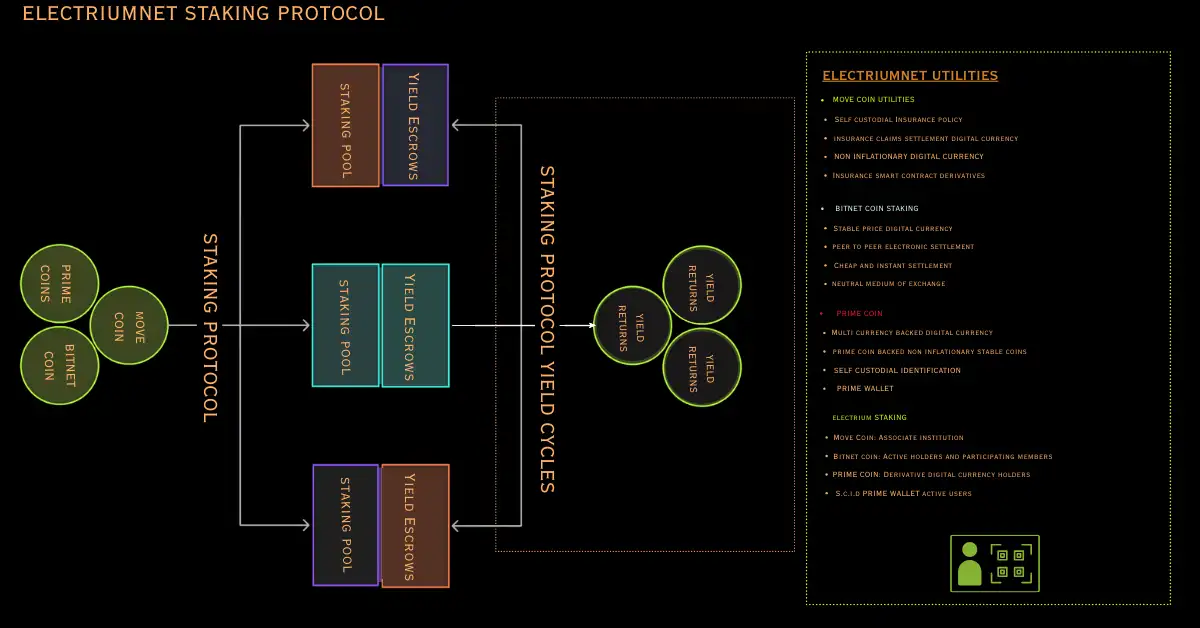

Treasury Incentives

The treasury will offer different creative programs and utilities as incentives to make its digital currency the most attractive financial instrument compared to other similar treasuries

The treasury offers yield returns in exchange for digital currency staking.

The treasury offers yield returns in exchange for Bitcoin holders staking their holdings.

These returns are directly tied to the treasury’s ability to generate productivity through active utility of its digital currency. The more effectively the treasury puts its assets to work, the more consistent and meaningful the yields become. Conversely, if the treasury lacks productivity and adoption is low, demand for the digital currency declines, rendering yield returns worth-less over time as capital value exits the market. Relying solely on price appreciation does not guarantee stability or real-world utility of the B.t.d.c and active ecosystems of adoptions will always play the primary role of validating its value and utility at all times.

Universal Ledger Protocol

A universal ledger protocol is the set of rules and standards designed to enable seamless, secure, and interoperable transactions across multiple, private digital ledgers in the blockchain networks. Its core purpose is to allow value & data as digital currencies to move as freely, fast and securely as digital information in a global network of offshore & onshore participants using securitized digital cryptocurrencies.

PRIVACY & SECURITY LEDGER WALLETS: The (ULP) is a collection of PRIVACY & SECURITY LEDGERS in a decentralized framework designed to enable secure, confidential, and owner-controlled data sharing and transactions across blockchain networks. It would prioritize cryptographic key management, end-to-end encryption, and user consent while facilitating interoperability of otherwise isolated ledgers into a cohesive ecosystem. The protocol is designed with embedded privacy safeguards for each ledger transaction, ensuring confidentiality and private data ownership. This guarantees that transaction details remain secure and protected within the private ledger wallet from the treasury & even under pressure from political or external influences.

Treasury Governance

The Treasury operates through a semi-decentralized autonomous organizational structure, maintaining minimal direct intervention in the established monetary policies of the treasury. Any changes or additions to policy are determined through a voting process facilitated by the protocol.

While the Treasury can propose new measures or modifications, final decisions are made by B.T.D.C holders. Voting power is weighted based on two key factors: the amount contributed to the vote and the duration for which a holder has maintained their B.T.D.C position. This structure ensures that those with the greatest stake and long-term commitment to the system have the most influence over its direction.

The treasury establishes its own tailored set of smart contract policies, specifically designed to foster network growth, ensure integrity, and enhance overall productivity.

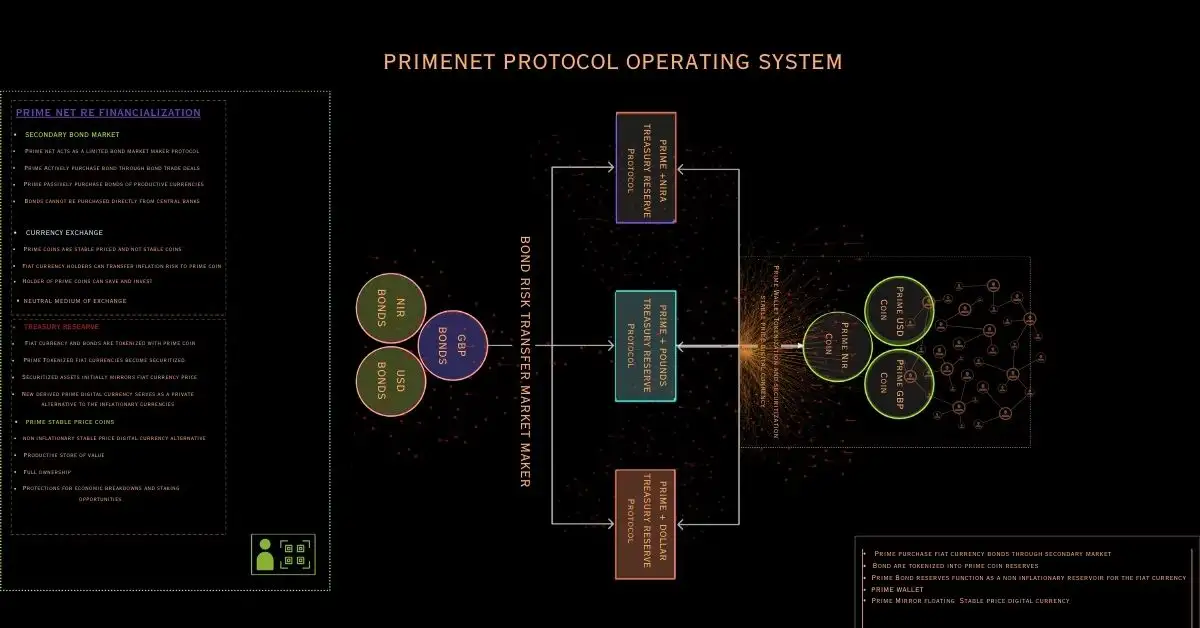

Case For An Alternative Digital Reserve Currency & The money system

The U.S. dollar has served as the world’s primary reserve currency for decades, underpinning global trade and financial systems. However, its dominant position has been increasingly undermined by the overextension of its influence. The widespread use of sanctions as a political tool and the unchecked expansion of the dollar supply have eroded global trust. In recent years, escalating trade conflicts with multiple nations have further strained the dollar’s credibility as a neutral medium for international exchange. Compounding this is the United States’ massive and ever-growing national debt reaching into the tens of trillions which raises serious concerns about long-term fiscal sustainability since the debt seems impossible to pay back which signifies an inevitable default and a crash in the dollar, Should the dollar lose its ability to uphold its obligations or face a default, the absence of a viable global alternative could trigger severe disruption across international markets, potentially crippling trade networks and destabilizing economies worldwide.

To understand the value of B.t.d.c, it’s essential to first understand money as a system & define money. In earlier communities, value created through skilled labor or knowledge was exchanged directly through barter. For instance, 100 chickens might be traded for one cow, or 10 grape seeds for a bottle of wine. But as communities grew more complex, so did their needs and the variety of goods and services exchanged. Barter became too impractical very quickly as not all goods held equal or easily comparable value, and direct exchange was inefficient. This led to the need for a common medium, something everyone would accept as a representation of value which is Money.

What is Money: Today money has certainly evolved and is now best defined as a system of precise representation, accurate account and tokenization of value that must be widely accepted, easily accessible, uniquely identifiable, durable and divisible to function effectively within an economy as Token of value for exchange

Money can take many forms of assets that uniquely represent value but throughout history, gold and especially silver have most reliably met the conditions to function as money. However, in today’s world of high-speed international trade, money is no longer just a store of value, it's a system & physical assets like gold and silver are no longer practical for settlement. Moving them quickly and securely across borders, accounting and ensuring validity of reserves are inefficient and slow, creating friction in the global economy that will either slow it down or lead to inflation and eventual collapse.

As a workaround, centralized systems like the Federal Reserve were created to hold reserves in one place and facilitate global settlements. But this model proved vulnerable to misuse particularly by the U.S. government leading to the abandonment of the gold standard and the rise of the current fiat currency system, which is no longer backed by any physical asset.

Bitcoin and Bitnet are digital assets that store value by recording transactions on an immutable ledger. Its token acts as the medium that facilitates the exchange of value.To illustrate: if Bitnet were replaced with gold as a reserve asset, both would serve the same purpose of storing and representing value but in different forms. Gold like other physical assets store value by being the object of value themselves while digital assets like bitcoin store value through the ledger record of ownership cryptographically represented in digital unique tokens.

What is Central Bank Digital Currency : C.B.D.C : It’s important to understand that most central banks, while appearing to function as public institutions, often operate as private entities and are influenced by private interests. These institutions hold immense power over the economy, by controlling the issuance of a country’s legal tender and shaping its monetary policy. The overall health of an economy, whether strong or struggling, is heavily impacted by the actions of both the government and, more critically, the central bank. Through continuous expansion of the money supply, central banks contribute to the gradual erosion of currency value over time, leading to persistent inflation that diminishes purchasing power across generations.

C.b.d.c is a programmed digital form of fiat currency issued and regulated by its central bank. As a currency, the C.B.D.C (Central Bank Digital Currency) introduces no fundamental improvements that make it a more reliable store of value. While it may be digitized, it remains a fiat currency subject to the same central banking policies that enable inflation, corporate bailouts, recessions, and systemic financial instability. In essence, C.B.D.Cs retain the core vulnerabilities of traditional fiat systems only with enhanced surveillance and control capabilities.

It is crucial to understand the core characteristics of C.B.D.Cs alongside other digital currencies to make informed and beneficial decisions. B.T.D.C presents a viable alternative to C.B.D.Cs, offering distinct advantages.

Programmability: C.b.d.c can be programmed to have expiry date set by the central bank. This means holders no longer have sovereignty over their value earned in money and must spend it before it expires which prevents them from saving or investing.

The c.b.d.c can be programmed to only be used for authorized purchases from authorized merchants by the government or central bank. This means if the government does not approve, you cannot buy or sell or start any business and shutting down a business will be a matter of a click..

It can be programmed to be frozen when the currency holder speaks against the interest of the government or central banks.

Tracking : All transactions are traced and tracked by the central bank using artificial intelligence which can be used against people in many situations. This makes it an effective tool for surveillance and government control.

No interest Yields : C.b.d.c is a powerful financial instrument that will generate passive profit for central banks but the interest is only shared within their circles and no yield is offered to customers or clients

B.T.D.C is designed to be a digital reserve currency for domestic & international trade settlements, and long-term value storage. Unlike fiat currencies & C.b.d.c, B.T.D.C cannot be arbitrarily printed or inflated, all units in circulation are validated through transactional purchase and not debt that leads to the inflationary boom and bust cycles, preserving its purchasing power and maintaining trust in its monetary integrity.