MOVE COIN: INSURANCE DIGITAL CURRENCY

Move Coin is a Layer-3, non-inflationary insurance-capital digital currency engineered to function both as a direct insurance settlement asset and as a reserve digital currency for the global insurance sector. Built on a public blockchain, Move Coin establishes a multipurpose settlement, liquidity, and reserve infrastructure that enables policyholders, insurers, and reinsurers to transact, settle premiums, process payouts, and manage claims using a non-inflationary medium of exchange independent of central-bank monetary policies. By combining self-custodial digital currency with the characteristics of a securitized, value-preserving asset, Move Coin creates a closed-loop, programmable financial system that complies with regulatory frameworks while fundamentally transforming how insurance capital is issued, stored, settled, and protected.

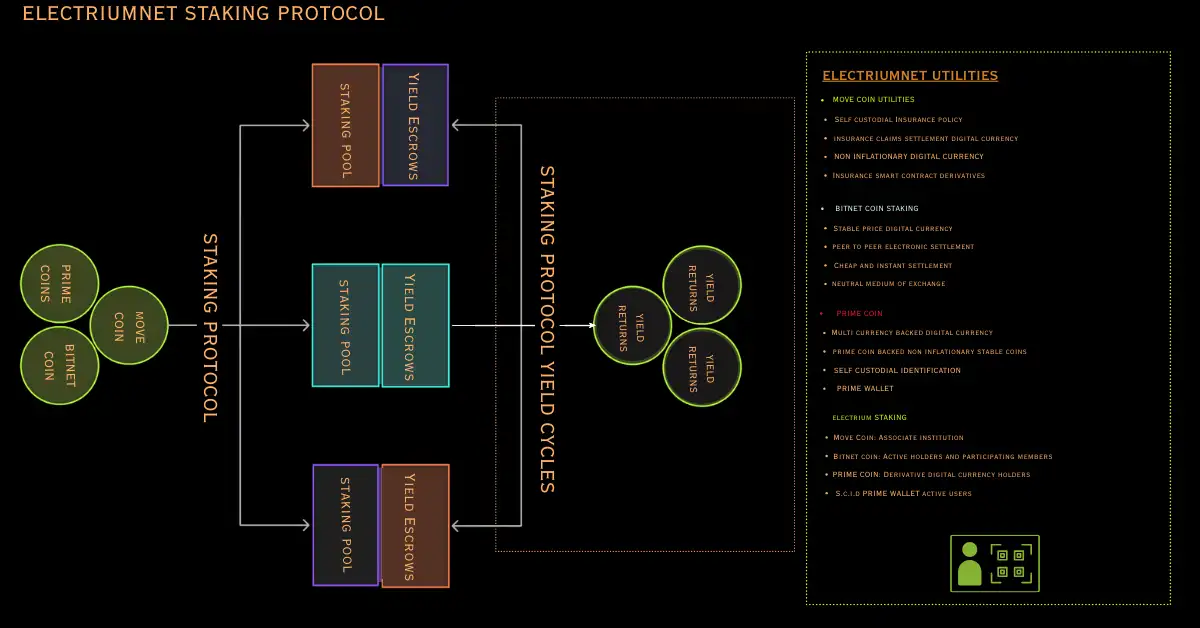

Protocol Role and Architectural Function

Move Coin operates atop the Electrium Network as the Layer-3 settlement and reserve layer that connects institutional insurance systems with a fully public, decentralized blockchain. The protocol enables the trustless conversion and transfer of smart-contract insurance policies into independently held digital assets, granting policyholders full ownership and direct custody of their policy value.

This evolution removes institutional custodial bottlenecks and transforms traditionally illiquid, institution-bound insurance policies into portable and programmable financial instruments capable of circulating across decentralized economic environments.

Beyond serving as a settlement currency, Move Coin introduces a new monetary logic for insurance capital formation. Through tokenizing and securitizing insurance premiums, Move Coin enables:

-

Democratized premium issuance, allowing insurance capital to be generated, priced, and collateralized through decentralized mechanisms rather than exclusively through institutional balance sheets.

-

Policy-backed digital reserves, where premium units are held in Move Coin rather than inflation-sensitive fiat currencies.

-

A decentralized reserve foundation for underwriting, providing industry-level capital support that remains insulated from macroeconomic instability.

Consequently, insurance premiums evolve from linear, one-directional payments into securitized digital reserves capable of supporting liquidity, capital adequacy, and long-term solvency throughout the insurance lifecycle.

Protection From Macroeconomic Risk Through Risk-Transfer Conversion

Traditional insurance transfers risk from individuals to insurers, yet insurers remain fully exposed to systemic macroeconomic forces recession, inflation, stagflation, sovereign-debt cycles, and fiat-currency devaluation. As a result, traditional insurance does not preserve the economic value of policy capital; it merely reallocates individual risk within an inflationary framework.

Move Coin resolves this systemic flaw through risk-transfer conversion, in which insurance premium units and policies are converted into a non-inflationary, stable-priced digital asset. This process:

-

Creates policy value that is internationally portable and macroeconomically neutral.

-

Provides insurers with insulation from inflation, stagflation, recession cycles, and sovereign-currency deterioration.

-

Shields both policyholders and insurance institutions from external monetary decay and domestic currency volatility.

In this model, Move Coin becomes not only a settlement token but also a reserve currency purpose-built to preserve insurance capital in real economic terms.

A Structural Shift in Insurance Digital Economics

Move Coin represents a foundational shift in how insurance capital is created, held, and protected. It elevates premiums into securitized digital reserves, empowers policyholders with self-custodial ownership, and delivers a programmable, non-inflationary settlement architecture operating outside the constraints of fiat-based systems.

By functioning simultaneously as a direct claims-settlement currency and as a reserve digital currency for insurance capital formation, Move Coin establishes the first decentralized financial standard explicitly designed to safeguard insurance value from macroeconomic instability. It transforms insurance from a reactive financial product into a sovereign digital asset class capable of sustaining liquidity, underwriting strength, and long-term economic integrity across generations.