DOME COIN: INSURANCE POLICY PROTOCOL

1. Introduction

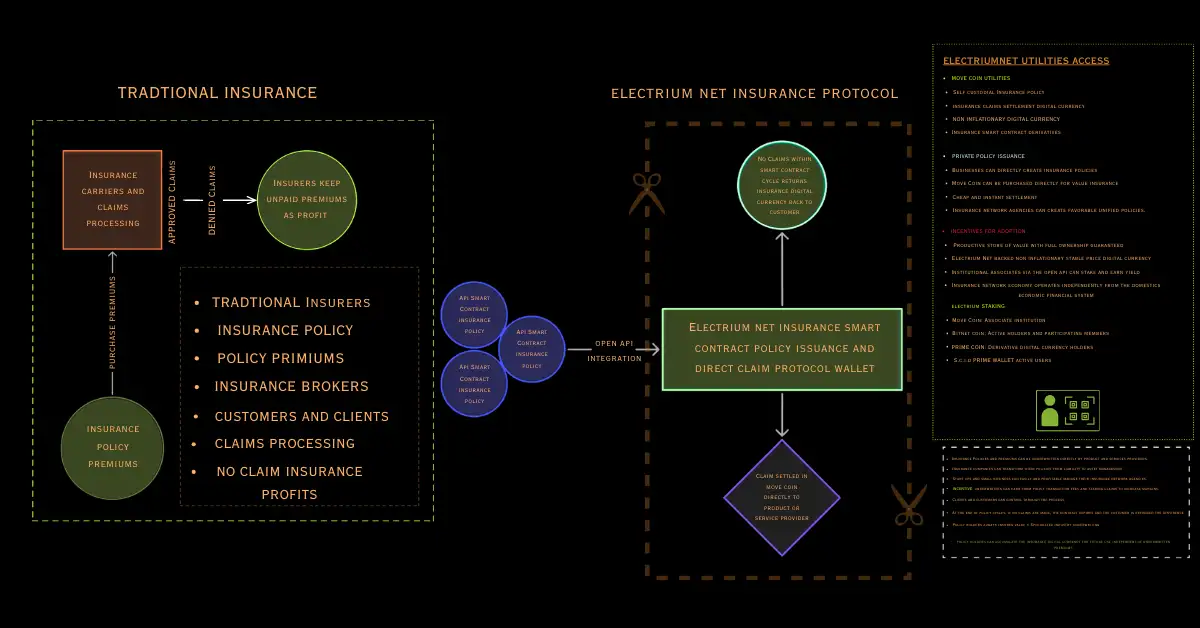

Dome Coin is a non-inflationary, stable-price insurance digital currency supported by the Electrium Aethernet Prime Protocol. It is engineered to insure, protect, and preserve capital value and sovereignty through programmable, self-executing insurance smart contracts. Dome Coin’s primary function is to guarantee that the valuation of Electrium’s insurance-policy layer remains stable, enabling participants to interact with the network’s utility digital currencies without exposure to volatility or systemic financial risk.

Unlike conventional stable coins whose stability relies on collateral reserves, algorithmic balancing, or monetary policy Dome Coin derives its stability from the intrinsic productive utility of the Electrium insurance network economy. Its value is anchored in the standardized insurance claim layer that forms the foundation of the broader Electrium ecosystem.

2. The Layer 0 Smart Contract Insurance Policy

At the core of Electrium’s architecture lies the Layer 0 Standardized Smart Contract Insurance Policy, a fully digitized, programmable, and universally interoperable version of a lifelong insurance agreement. This protocol:

-

Encodes the rules, obligations, valuations, and payout logic of traditional insurance

-

Ensures universal auditability, transparency, and verifiability

-

Provides cross-jurisdiction, cross-institution interoperability

-

Functions as the foundational contract for all derivative insurance instruments in the Electrium ecosystem

By embedding insurance directly into tamper-resistant smart contracts, Electrium introduces a trustless, autonomous insurance framework capable of serving as the baseline for global institutional, industrial, and consumer-level insurance products.

3. The Role of Dome Coin in the Electrium Architecture

3.1 A Reserve-Grade Digital Insurance Claim

Dome Coin differs fundamentally from traditional transactional currencies. It is not designed for daily peer-to-peer exchange. Instead, Dome Coin serves as a reserve-grade, tokenized lifelong smart contract insurance policy that facilitates the issuance and settlement of smart contract insurance policies engineered to:

-

Maintain value across multi-generational time horizons

-

Preserve the economic integrity of policyholders and institutions

-

Provide a stable asset layer from which specialized utility currencies can be issued

Each Dome Coin represents a unitized, stable component of the Electrium DomesDay Digital Asset, the underlying digital insurance asset that anchors the value of all derivative utility currencies operating within the Electrium Network.

3.2 Capital Preservation, Sovereignty, and Risk Protection

Dome Coin provides:

-

Capital preservation through non-inflationary asset design

-

Sovereign protection by lifting insurance capital away from volatile fiat systems

-

Risk insulation by guaranteeing smart contract policy value regardless of macroeconomic shocks

This enables policyholders, institutions, and network participants to interact with digital assets in an environment free from inflationary decay, currency devaluation, or custodial instability.

4. Dome Coin as the Layer 1 Reserve Insurance Protocol

The DomesDay digital asset represented in its granular form as Dome Coin functions as a Layer 1 Reserve Insurance Protocol that supports:

4.1 Institutional Adoption as a Productive Reserve Asset

Institutions can hold Dome Coin as a long-term, non-inflationary reserve asset, replacing traditional fiat reserves whose value erodes under inflation, recession, and monetary policy instability.

4.2 Collateralization for New Insurance Products

Dome Coin can be used to collateralize the issuance of programmable insurance products across industries, transforming policy creation into a fully digital, capital-efficient process.

4.3 Issuance of Domain-Specific Insurance Derivatives

The Layer 1 protocol enables the creation of derivative smart contract insurance policies, including:

-

Automotive insurance

-

Health and medical insurance

-

Property and real-estate insurance

-

Business and industrial risk protection

-

Specialized commercial and event-based insurance products

These derivative layers maintain a direct valuation link to Dome Coin, ensuring stability and consistent pricing across the entire digital insurance market.

4.4 Network Effects and Long-Term Stability

As more institutions adopt Dome Coin and its policy framework:

-

Trust in the underlying protocol expands

-

Liquidity and stability increase

-

Smart contract insurance markets deepen

-

The reserve layer strengthens, enhancing multigenerational capital security

Dome Coin’s economic soundness therefore increases organically with network adoption.

5. A Digital Standard for Insurance Value Preservation

Dome Coin represents a structural evolution in insurance economics. Through its integration into the Electrium Aethernet Prime Protocol, it:

-

Converts lifelong insurance commitments into programmable, self-custodial digital assets

-

Protects economic value against inflation, monetary instability, and systemic financial risk

-

Establishes a universal reserve currency for the global digital insurance industry

-

Ensures that capital stored within the insurance network remains productive, sovereign, and protected

By serving as the backbone of Electrium’s insurance economy, Dome Coin introduces a new era of digitally sovereign, non-inflationary insurance capital capable of sustaining value across generations.