PRIME COIN: PRIME NET OPERATING SYSTEM

Executive Summary

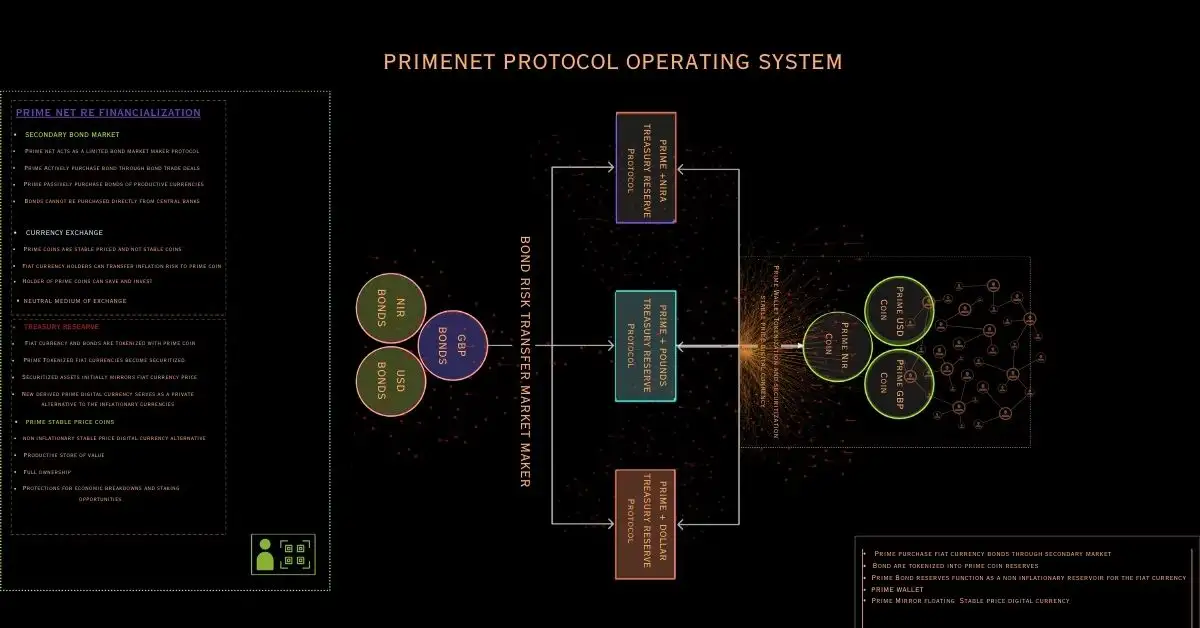

Prime Coin is an enterprise-grade, multi-fiat, reserve-backed stable price digital currency engineered to support privately issued digital currency across Great Britain and the wider Commonwealth. Designed as a non-inflationary risk-transfer and stabilization instrument, Prime Coin allows government bondholders to shift inflation and default exposure into a digital asset optimized for value preservation and economic productivity.

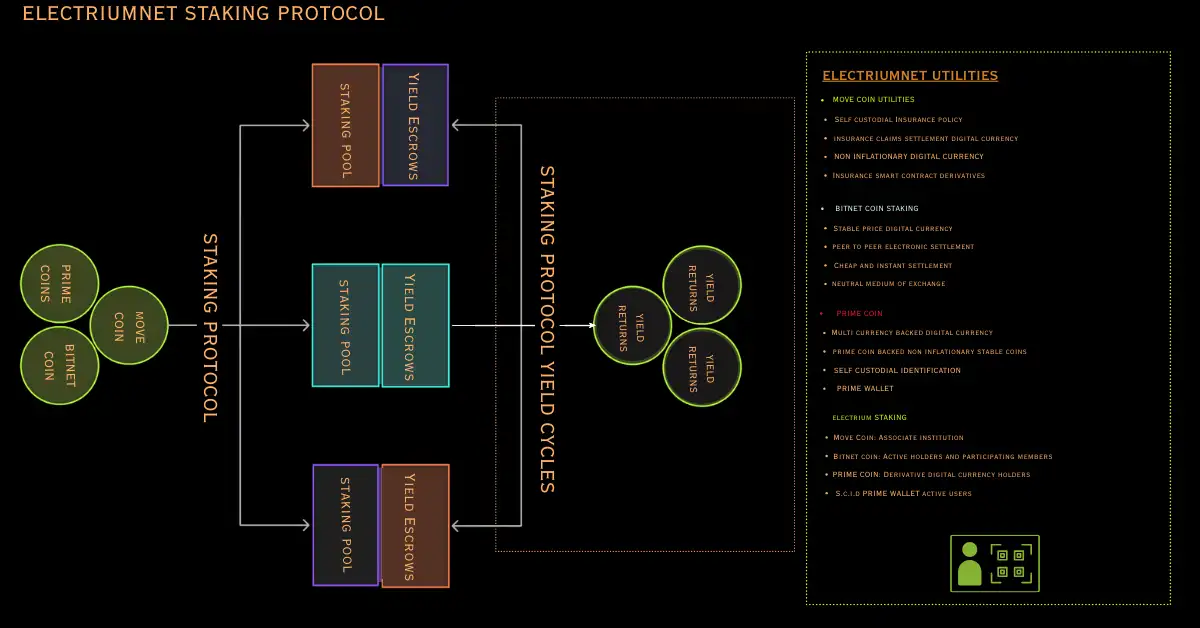

At its core, Prime Coin operates as a counterbalancing economic mechanism that absorbs excess currency inflation within Commonwealth markets and converts this absorbed value into equity. This value is then redistributed into participating economies through structured staking programs, bond-market operations, and development incentives. Through Prime Net, its economic deployment ecosystem, Prime Coin transforms monetary expansion into productive domestic capital rather than speculative financial activity.

Prime Coin establishes the foundation for a unified, digitally enabled value-capital framework capable of enhancing domestic productivity, strengthening interregional trade, and facilitating efficient international settlement across the Commonwealth.

1. Introduction

British economic performance has long been hindered by structural inefficiencies, overreliance on external financial markets, and limited mechanisms for converting capital flows into domestic productivity. Traditional currency expansion channels predominantly debt-driven do not guarantee proportional increases in economic output.

Prime Coin addresses these weaknesses by introducing a new digital capital architecture that realigns monetary issuance with measurable productivity. It expands the financial capacity of Great Britain without exposing the economy to inflationary decay or reliance on central-bank debt cycles.

2. The Role of Prime Coin as a Structural Market Intervention

Prime Coin functions as a stabilizing reserve asset and a strategic market participant. Its dual role is defined by:

2.1 Inflation Absorption and Conversion

Prime Coin absorbs inflationary value circulating within Commonwealth currencies. Rather than letting inflation dilute purchasing power, the system converts these excesses into digital equity and channels them into productive economic activity.

2.2 Secondary Market Bond Acquisition

Prime Coin operates as a primary purchaser of government bonds in secondary markets. This mechanism:

-

Redirects investor returns back into the domestic economy

-

Transfers bond-default and inflation risks from investors to Prime Coin

-

Converts sovereign liabilities into a counter-inflationary digital asset

This transforms traditional bond markets from passive yield instruments into active engines of domestic reinvestment.

3. Capital Recirculation Mechanism

The architecture underpinning Prime Coin is designed to prevent the outflow of capital that typically occurs when external investors extract returns from UK sovereign debt.

Prime Coin replaces this outward extraction cycle with a closed-loop economic circuit, ensuring that value generated in Britain remains in Britain.

Through this system:

-

Monetary issuance is tied to utilitarian activity

-

Capital recirculates into national infrastructure, manufacturing, innovation, and human-capital development

-

Financial gains are redistributed based on measurable economic contribution

-

Extractive financial models are replaced with regenerative domestic reinvestment

Prime Coin transforms currency creation from a debt-driven liability into a productivity-driven asset.

4. An Integrated Economic Catalyst

Prime Coin is not a passive digital currency it is an active allocator of value engineered to restructure how capital circulates through the Commonwealth.

4.1 Beyond Medium of Exchange

Unlike traditional stable coins or fiat currencies, Prime Coin:

-

Directs liquidity into productive sectors

-

Rewards value creation through staking and performance-based incentives

-

Aligns monetary supply with real output rather than speculative financial flows

4.2 Productive Monetary Expansion

In this system, inflationary expansion is not eliminated, it is repurposed.

Instead of eroding citizens' purchasing power, inflationary excess is:

-

Absorbed

-

Converted into equity

-

Reallocated to domestic economic growth initiatives

Prime Coin therefore converts a structural macroeconomic vulnerability into a national growth engine.

5. The Commonwealth Economic Framework

Prime Coin functions as the reserve layer for a unified multi-fiat digital economy spanning the Commonwealth. It supports a network of privately issued stable coins each pegged to regional fiat currencies but collateralized and stabilized by Prime Coin’s reserve structure.

This enables:

-

Interoperable digital settlement across Commonwealth nations

-

Reduced foreign-exchange friction

-

Stronger financial alignment across member states

-

A shared digital capital market infrastructure

Prime Coin thus becomes the economic connective tissue linking British and Commonwealth markets into a cohesive, digitally powered trade ecosystem.

6. Strategic Vision

Prime Coin establishes a new financial scaffolding capable of reversing decades of structural stagnation. It positions Great Britain not as a late participant in the global digital transition, but as:

-

An architect of sovereign digital capital systems

-

A leader in counter-inflationary monetary engineering

-

A pioneer of decentralized productivity incentives

-

A global hub for stable coin-enabled trade and economic modernization

This framework transforms national monetary policy from a cycle of debt and austerity into a system powered by productivity, innovation, and value creation.